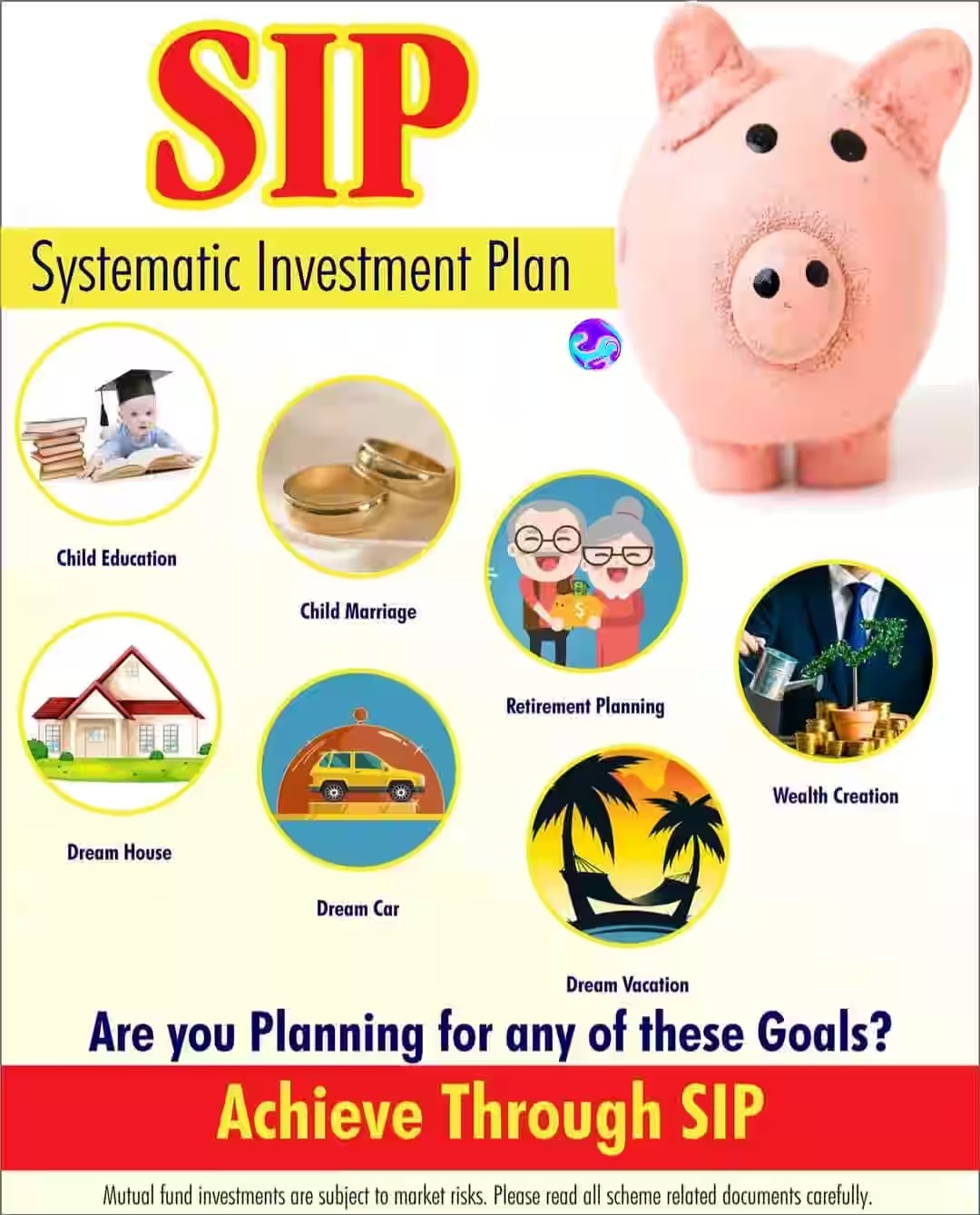

“We proudly stand as your dependable allies in the art of shaping financial strategies that embrace both the present and the future. Our commitment is to remain agile, adjusting seamlessly to meet your evolving requirements. Our overarching mission is crystal clear: to guide you in identifying your genuine priorities and providing you with the tools to turn your distinctive dreams into realities. Through every challenge and triumph along your life's path, you can rely on us to be your steadfast companions."

Latest News Colors

Colors